Accounts Payable Automation has changed how organizations process supplier invoices because today, after digital transformation, most operations in invoice management can be digitized.

Although accounts payable seems to be a simple procedure, the complexity of the process grows as the number of suppliers and transactions increases. As a result, the number of errors and inconsistencies also increases. Accounts payable automation helps eliminate these issues by streamlining operations and reducing human intervention.

How does Accounts Payable Automation work?

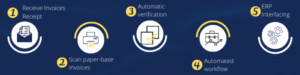

First, it is necessary to convert all invoices and documents to a single standard digital format. The documents can be PDF, paper, electronic, XML, and other arrangements. These documents can come by mail or email.

Using Dokumentive’s automated scanning and data extraction solution, you can quickly scan all documents. The system will transform them into digital copies so that the automated Accounts Payable solution can read the most important data from each document, such as amounts and payment dates.

After this, the system will automatically verify all information, encode it, and start the workflow process, for example, making automatic payments, sending documents to the people who need to sign them, etc. This workflow must be pre-established by the company and set up the process rules that the solution will follow. You can also integrate your AP automation solution to any other system you use in your company, such as SAGE, SAP, Dynamics 365, and others.

The accounts payable automation solution can match vendor-based invoices with their corresponding purchase orders and GDRs (Goods Delivery Receipts) with little or no human intervention. A/P invoice automation enables a contactless process, with payments approved automatically after verification of the invoice.

Implementing automation in your business demands research to find a flexible, easy-to-use, and affordable solution. Therefore, at Dokumentive, we offer a modular solution, in which you pay only for the features you need from the solution. Furthermore, we provide the entire implementation in less than 2 days and training and 24-hour support.

e-Doc360 is a versatile solution that moulds itself to your needs and will revolutionize your company’s accounts payable process. You can convert your traditional error-prone, paper-based invoice process to a faster, more accurate and user-friendly digital program with an automated solution.

What are the benefits of AP Automation?

The benefits of accounts payable automation are numerous. Let’s mention a few here:

- Invoice automation shortens approval and payment cycles, decreasing processing and labour expenses for businesses.

- Digitizing invoices reduces invoice errors and allows for a more uniform flow of data.

- It also improves the visibility and transparency of the invoice payment cycle. As a result, management and leadership can make more informed judgments.

- AP automation methodically regulates invoice approval and payment deadlines. It optimizes the company’s working capital management.

- It saves a lot of time and labour.

- AP automation is also good for the environment because it minimizes the amount of paper used.

To learn more in detail about the benefits of the Accounts Payable Automation solution, read the article about the 5 benefits of Accounts Payable Automation.

Now that you are familiar with all the processes and some of the benefits that automation will bring to your accounts payable department, contact us for a free customized demo to your needs to understand better how it will fit into your business.